Financial challenges are increasingly common for older adults. About 30 percent of older adults in the U.S. live on incomes that are near the poverty threshold and about one third of older adults in the U.S. report financial strain, meaning they have difficulty making ends meet. Importantly, financial challenges are modifiable social determinants of health that should be addressed.

Older adults facing financial challenges may find it difficult to meet basic needs. They may run out of food or medications near the end of the month when funds run low. They may not be able to afford housing that is properly heated or that meets their needs to safely age in place in their own homes. In addition to lacking basic necessities, individuals face greater day-to-day stress managing household finances. There is good evidence that older adults facing financial challenges are more likely to become disabled and die earlier than their wealthier peers.

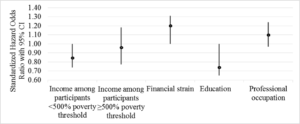

Our study, published today in BMC Geriatrics, links financial challenges to dementia, which is a costly and disabling condition affecting 10 percent of older adults in the U.S. We analyzed data collected over six years from a national sample of 5,034 U.S. older adults to identify new cases of dementia. We compared four different measures of socioeconomic status (income, financial strain, education, and professional occupation) to see which of these predicted new cases of dementia.

In our study, older adults who experienced either low income or financial strain were more likely to develop dementia than those who didn’t. Education, which has already been linked to dementia in other studies, predicted dementia in our study as well. In fact, The Lancet Commission on Dementia identifies low education as a key dementia risk factor. However, when we compared education to income and financial strain we found similar results for all three socioeconomic measures. This suggests that low income and financial strain may be just as important as low education with regard to risk of dementia.

These results are important because financial challenges may actually be more modifiable for older adults than education. Most adults complete their educational training early in life, but financial challenges could be addressed at any point in the life course.

Many programs and policies are already in place that are intended to support older adults facing financial challenges. Public benefits, entitlement programs, and tax credits may alleviate financial challenges. However, these programs are often under-utilized. For example, the U.S. Supplemental Nutrition Assistance Program provides money to buy food but only about 40 percent of eligible older adults use the program.

Results from this study complement results of another study our team published in BMC Geriatrics last year, which highlighted the importance of housing quality for financially strained older adults. In that study, we used the same national sample of U.S. older adults to track changes over time in both financial strain and markers of home disorder such as tripping hazards, pests, or broken furniture and flooring. We also tracked mobility over the same time period.

Efforts to provide basic necessities, including food, medications, and safe and accessible housing may help prevent disability and dementia for financially strained older adults.

In that study, financial strain and home disorder interacted with each other over time – financial strain predicted more home disorder and home disorder predicted greater financial strain. Importantly, both financial strain and home disorder predicted mobility limitations among older adults, suggesting that both play a role in functional decline. These results suggest that older adults with financial strain may slip into a downward spiral of worsening home conditions and worsening financial strain that leads eventually towards disability.

These results highlight the importance of early intervention to alleviate financial strain in order to prevent disability for healthy older adults. Also, these results suggest that interventions should include improving home conditions for financially strained older adults, which may break the link between financial strain and disability.

Together, these two studies add to a growing body of evidence linking financial challenges, including low income and financial strain, with poor health outcomes for older adults. As populations age around the world, we should pay greater attention to supporting older adults facing modifiable financial challenges. Our research suggests that efforts to provide basic necessities, including food, medications, and safe and accessible housing may help prevent disability and dementia for financially strained older adults. Existing resources for food, housing, and health care supports should be strengthened to meet the growing needs of populations aging with financial challenges.

Comments